Pyramid schemes have scammed investors out of millions, often disguising themselves as legitimate business opportunities. They promise guaranteed high returns, but instead of generating real profits, these schemes rely on constant recruitment to sustain payouts. When new investors stop joining, the structure collapses, leaving most participants with financial losses.

This blog will break down what pyramid schemes are, how they operate and how they differ from other investment frauds like Ponzi schemes. You’ll also learn how to recognize the warning signs and explore your legal options if you’ve already been affected.

If you suspect you’ve been targeted by a fraudulent investment scheme, understanding your rights is the first step toward financial recovery. Here’s what you need to know.

What Is a Pyramid Scheme?

A pyramid scheme is a fraudulent business model where participants earn money primarily by recruiting others rather than selling actual products or services. These schemes often collapse once recruitment slows, leaving most participants with financial losses.

How Pyramid Schemes Disguise Themselves as MLMs

Many pyramid schemes present themselves as multi-level marketing (MLM) programs, making them harder to recognize. While legitimate MLMs exist, fraudulent ones operate like pyramid schemes by prioritizing recruitment over real product sales.

The Difference Between a Legitimate MLM and a Pyramid Scheme

The key distinction between a legal MLM and a pyramid scheme is how participants make money:

- Legitimate MLMs focus on selling real products or services, with earnings based primarily on personal and team sales.

- Pyramid schemes generate revenue mainly through recruitment, often requiring participants to pay upfront fees or purchase large amounts of inventory with little emphasis on actual sales.

If an MLM requires significant upfront investments, offers higher commissions for recruiting than selling or has little emphasis on real product sales, it is likely a pyramid scheme in disguise.

How Pyramid Schemes Work

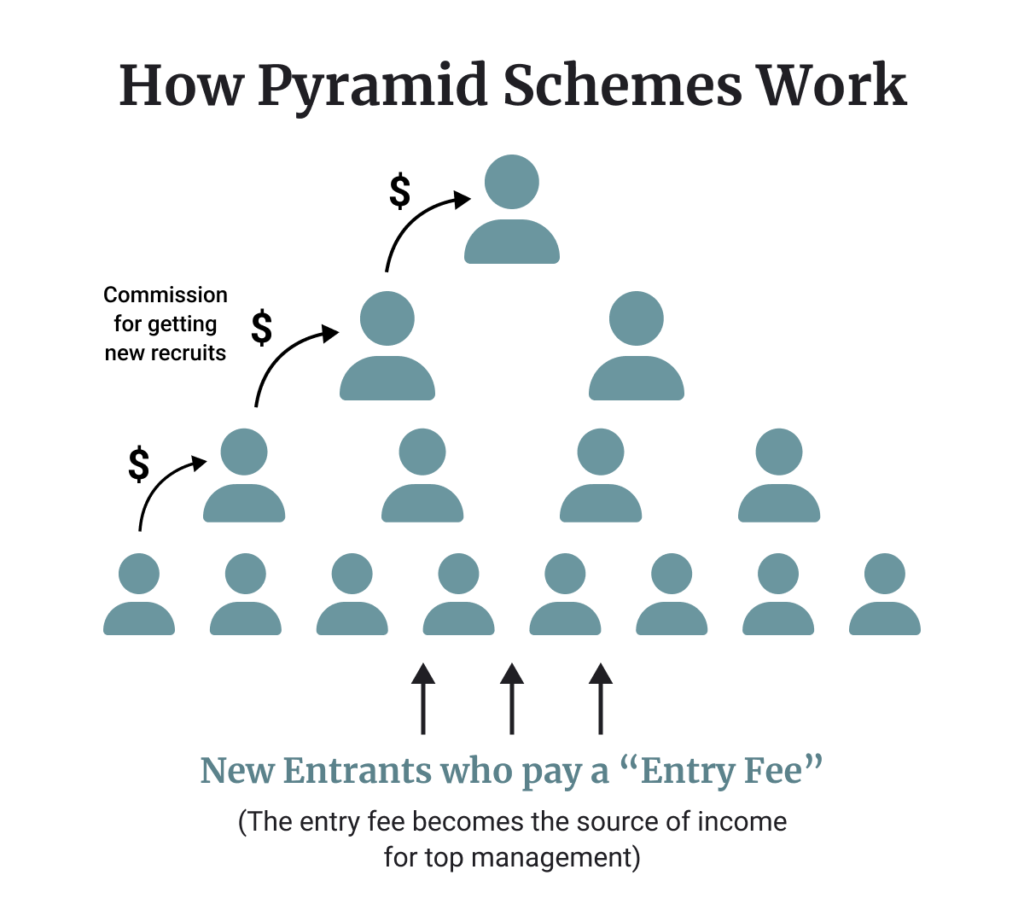

Pyramid schemes operate under the illusion of a profitable investment opportunity, but in reality, they are unsustainable and designed to fail. Unlike legitimate businesses, these schemes rely entirely on recruitment to generate profit, rather than sales of legitimate products or services. Here’s how a pyramid scheme is typically structured:

- Initial Investment – Victims are required to pay an upfront fee to join the program, often disguised as a “starter kit” or an “exclusive business opportunity.”

- Recruitment Model – Instead of earning most of their money through sales, members must recruit others to recover their investment and make a profit.

- Money Distribution – New members’ payments funnel up the pyramid, enriching those at the top while lower-level participants struggle to earn anything.

- Collapse – At a certain point, sustaining the scheme would require more recruits than there are people in the U.S., making it mathematically impossible to continue. When recruitment slows, the scheme inevitably falls apart with most participants losing money.

Pyramid Scheme vs. Ponzi Scheme: Key Differences

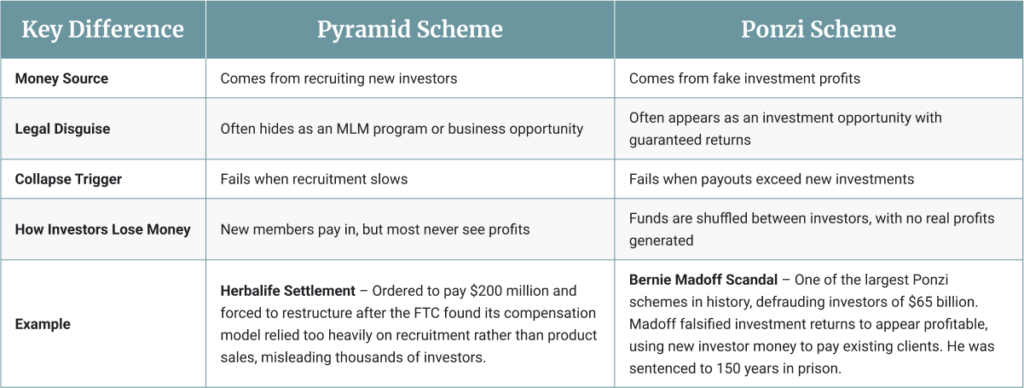

Pyramid schemes and Ponzi schemes are both fraudulent investment scams that promise high returns but rely on new investor money rather than legitimate business activity. While they share similarities, they operate differently:

How To Identify and Avoid a Pyramid Scheme

Pyramid schemes can be difficult to spot, as they are often disguised as legitimate business opportunities. However, there are key warning signs that can help you determine whether an investment is a scam. Here’s what to watch out for:

- Emphasis on recruitment over sales – If the company promotes recruiting new members as the primary way to make money rather than selling an actual product, be cautious. Watch out for phrases like “Build your own team and watch the money flow in” or “The more people you recruit, the more you earn!”

- Unusual fee structures – Pyramid schemes often require high upfront costs, mandatory product purchases or ongoing fees with little to no return. They may use language like “Invest in yourself — just a small fee to unlock your earning potential!” or “The more you spend, the more you make!”

- Promises of “easy” money and passive income – Be wary of claims that you can get rich quickly with minimal effort. Legitimate businesses require real work. Red flag phrases can include things like “Earn thousands a month with little effort!” or “Make passive income for life!”

- Lack of transparency – If a company is vague about how profits are made, where your money is going or whether they are registered with regulators, that’s a major warning sign. They may try to dismiss your questions with phrases like “Trust the process — you’ll understand once you start making money!” or “Our income system is proprietary and confidential!”

Before committing to any investment opportunity, take a step back and do your homework. Look into the company’s history, check for independent reviews and verify whether the business is registered with the SEC or state securities regulators. A legitimate business should have a clear, transparent revenue model. If earnings seem to depend more on bringing in new members than selling an actual product or service, that’s a huge warning sign.

It’s also important to ask questions. A trustworthy company won’t hesitate to provide detailed financial statements or explain exactly how its investors make money. If responses seem vague or evasive, that’s a strong indication something isn’t right. Scammers rely on trust and financial ambition to pull people in, which is why pyramid schemes can be so destructive.

How To Sue for Investment Fraud

Victims of pyramid schemes may have legal grounds to recover their losses. Lawsuits can be filed against scheme organizers, financial advisors or brokerage firms that have played a role in promoting or enabling the fraud.

Taking action starts with gathering evidence, such as contracts, emails, payment records and communications that show false promises or deceptive practices. Reporting the scheme to state securities regulators or the SEC can also help strengthen a case and potentially prevent further harm to others. Since investment fraud cases can be complex, seeking legal guidance can provide clarity on the best path forward.

If you’ve lost money in a pyramid scheme, exploring your legal options is the first step toward holding those responsible accountable.

Class Actions and Lawsuits Against Pyramid Schemes

When a pyramid scheme defrauds a large group of investors, a class action lawsuit can be one of the most effective ways to seek justice. By filing together, victims can present a stronger case, share legal costs and increase their chances of recovering lost funds. Instead of fighting alone, class actions give individuals the power of numbers, making it harder for fraudulent companies to escape accountability.

Over the years, several major pyramid schemes have faced legal action:

- Herbalife – In 2016, Herbalife settled a lawsuit for $200 million after the FTC accused it of operating an illegal pyramid scheme that misled thousands of distributors into believing they could make substantial incomes. The company was forced to restructure its compensation system to focus on real product sales rather than recruitment.

- AdvoCare – In 2019, the FTC shut down AdvoCare’s multi-level marketing (MLM) structure, calling it a massive pyramid scheme that scammed distributors out of millions of dollars. The company and its executives were permanently banned from MLM operations and ordered to pay $150 million in restitution for deceiving participants with false income claims.

- LuLaRoe – This popular clothing company settled a $4.75 million lawsuit in 2021 after being accused of running a fraudulent business model that misled sellers about income potential and pressured them to purchase large amounts of inventory, resulting in financial losses for many distributors.

- Financial Education Services (FES) – In 2023, the FTC permanently shut down FES after it scammed consumers out of more than $213 million through a bogus credit repair scheme. The company lured people in with promises of financial freedom but instead charged illegal upfront fees while prioritizing recruitment over any real services.

Though no lawsuit can guarantee full financial recovery, class actions make it possible to hold fraudsters accountable and help prevent future scams. If you’ve lost money in a pyramid scheme, exploring legal options could be the next step toward recovering what was taken from you.

Lost Money in a Pyramid Scheme? Sonn Law Group Can Help

Pyramid schemes leave countless investors with devastating financial losses, but legal action may help you recover what you’ve lost. Sonn Law Group has decades of experience representing victims of investment fraud, Ponzi schemes and securities violations, holding fraudulent organizations accountable. If you’ve been scammed, our legal team is ready to review your case and fight for the compensation you deserve. There are no upfront costs, just the legal guidance you need.

Take the first step today by contacting Sonn Law Group for a free consultation.

CONTACT US FOR A FREE CONSULTATION

Se Habla Español

Contact our office today to discuss your case. You can reach us by phone at 844-689-5754 or via e-mail. To send us an e-mail, simply complete and submit the online form below.