To appreciate the subprime mortgage crisis, which will lead to significant litigation over the sale of MBSs, one must review the major events of 2006 and 2007. Many lenders to risky borrowers were hit hard in 2006 and 2007 by the subprime mortgage crisis.

To appreciate the subprime mortgage crisis, which will lead to significant litigation over the sale of MBSs, one must review the major events of 2006 and 2007. Many lenders to risky borrowers were hit hard in 2006 and 2007 by the subprime mortgage crisis.

Defaults began to significantly rise as home owners, who received previously-affordable adjustable rate home loans during the real estate boom, started grappling with higher loan rate resets. While some borrowers have weathered the rate crunch, many others have defaulted on their mortgage payments.

As a result, many of the largest subprime mortgage lenders including, but not limited to, New Century Financial Corporation, Countrywide Financial Corp., Ameriquest Mortgage, HSBC Holdings plc and Fremont General Corp., began experiencing significant problems in their mortgage loan portfolios in 2006, with New Century Financial Corporation filing for bankruptcy. In early 2007, many subprime mortgage lenders filed for voluntary bankruptcy protection, ceased originating mortgage loans and/or ceased conducting business altogether.

Furthermore, many of these companies also face criminal investigations into their accounting and business practices. On March 13, 2007, the Wall Street Journal reported that “amid mounting defaults in the market for subprime mortgages, some big banks and mortgage companies are striking out in their efforts to wrest compensation from originators of those high-risk, high-return loans.” According to the Wall Street Journal article, “banks and larger mortgage lenders are trying to force smaller mortgage lenders to buy back some of the same loans that the larger entities eagerly purchased from the smaller mortgage originators in 2005 and 2006, by enforcing what the industry calls repurchase agreements.”

The article further stated that “HSBC is dispatching lawyers to U.S. courts to try to collect from mortgage originators, fighting over often-small amounts in a myriad of cases. Squeezed by the onslaught of defaults and repurchase demands, many originators such as SouthStar Funding, LLC and American Freedom Mortgage, Inc. have indicated that they cannot afford to buy back their loans or are pursuing bankruptcy protection.

The following message posted on the SouthStar Funding, LLC web site on April 2, 2007 is an example of what happened to many small mortgage originators and wholesale lenders during this period:

“SouthStar Funding, LLC sincerely regrets that it was necessary to cease its mortgage lending operations. The recent unprecedented downturn and policy changes in the mortgage industry necessitated this action. SouthStar appreciates its employees’ and customers’ loyalty to the company throughout the years.”

Southstar Funding LLC filed for voluntary bankruptcy protection on April 11, 2007. Southstar Funding, LLC was created in 1998 when former executives from Homebanc Mortgage left to form their own company.

In the wake of the mortgage industry meltdown, Senator Christopher Dodd, Chairman of the Banking Committee held hearings in March 2007 and asked executives from the top five subprime mortgage companies to testify and explain their lending practices; Dodd said, “‘predatory lending practices’ endangered home ownership for millions of people.”

Lou Ranieri of Salomon Brothers, inventor the mortgage backed securities market in the 1970s, warned of the future impact of mortgage defaults: “This is the leading edge of the storm…If you think this is bad, imagine what it’s going to be like in the middle of the crisis.”

In his opinion, more than $100 billion of home loans are likely to default when the problems in the subprime industry appear in the prime mortgage markets.

In early 2007, the so-called Alternative-A (Alt-A) mortgage sector, which loans to borrowers with better credit than subprime borrowers but not quite prime, also started to evidence signs of distress. The delinquency and default rate for Alt-A mortgages has been considerably less than for subprime mortgages, according to First American Loan Performance, a research firm based in San Francisco, California that looks at mortgage loans packaged into securities and sold to investors.

The First American data shows that January 2007 payments were 60 days late on 14.3 percent of subprime loans, up from 8.4 percent a year earlier. The late-payment figures for Alt-A loans was 2.6 percent in January, up from 1.3 percent a year earlier. Alt-A borrowers traditionally have credit scores as high as prime borrowers, but often provide less documentation of their finances; in recent years, however, some Alt-A borrowers have had credit scores closer to subprime borrowers and still were not asked for full documentation.

Doug Duncan, chief economist for the Mortgage Bankers Association in Washington, D.C., said that Alt-A mortgages made up a small share of the U.S. market at about 6 percent of outstanding loans. Loans to prime customers, who are the most creditworthy, make up 74 percent; those to subprime borrowers are about 11 percent, and government-backed loans total about 9 percent.

The Mortgage Bankers Association predicts an increase in delinquencies and defaults in the Alt-A market this year, and that the bigger problem was that investors appeared less willing to invest in these loans because of the deepening subprime problems. That will be a factor in slowing mortgage origination in 2007 to an estimated $2.2 trillion from a peak of $3.9 trillion in 2003 and $2.5 trillion last year.

Companies that originate the Alt-A mortgages have found that investors are less willing to buy securities that are backed by mortgages — or are demanding significantly higher returns. One Alt-A lender, American Home Mortgage Investment Corporation of Melville, New York, announced in early April, 2007 that it was having trouble selling its mortgages into the secondary market and would have to cut its earnings forecast for the quarter and the year.

Not surprisingly, American Home Mortgage filed for bankruptcy in August, 2007. Other Alt-A lenders that have taken hits in the market are First Horizon National Corp. of Memphis, Tennessee, and M&T Bank Corp. in Buffalo, New York.

A June 1, 2007 report by Friedman, Billings, Ramsey Group Inc., a securities firm in Arlington, Virginia, indicated that a total of 11 percent of the loan collateral for all subprime mortgage bonds had payments at least 90 days late, were in foreclosure or had the underlying property seized. In May 2005, that amount was 5.4 percent.

Interestingly, Friedman Billings and Ramsey Group, Inc. (NYSE: FBR) sold its subprime division, First NLC back to the original ownership, Boca Raton, Florida based Sun Capital Partners group in July, 2007.

On or about June 9, 2007, Democrats led by House Financial Services Committee Chairman Barney Frank blamed a lack of oversight by the Federal Reserve for allowing abuses in the subprime-mortgage market. U.S. House Financial Services Committee Chairman Barney Frank threatened to take away the Federal Reserve’s legal power to write consumer-protection rules, telling an official the board must “use it or lose it.”

“If the Fed doesn’t start to use that authority to roll out the rules, then we’ll give it to somebody who will,” Frank, a Massachusetts Democrat, told Fed Governor Randall Kroszner during a committee hearing in Washington in June, 2007.

Congressional overseers are intensifying pressure on the Federal Reserve over what they consider a lack of action on consumer protection. Senate Banking Committee Chairman Christopher Dodd, a Connecticut Democrat, said June 7, 2007 he wants the Fed to write tougher regulations to curb abusive mortgage lending. Dodd’s pressure prompted the Fed to schedule a public hearing tomorrow in Washington to examine its authority to write new consumer-protection rules in subprime mortgage lending.

“Patience is wearing thin,” said Representative Paul Hodes of New Hampshire, president of the freshman House Democrats and a member of Frank’s committee. Frank’s “lack of patience I think is indicative of the frustration that members are feeling with the Fed.”

On June 21, 2007, H&R Block Inc. reported that it swung to a quarterly loss as the challenging market for subprime mortgages continued to hurt results. The net loss reflected discontinued operations, primarily the company’s mortgage business. H&R Block Inc. has announced that it is in the process of selling off its Option One and H&R Block Mortgage Corp. businesses, a transaction expected to be completed during the second quarter of fiscal 2008. “Conditions in the non-prime mortgage industry continued to be challenging during the 2007 fourth quarter,” the company said in the earnings release.

“Mortgage operations were particularly impacted by deteriorating conditions in the secondary market, where reduced investor demand for loan purchases, higher investor yield requirements and increased estimates for future losses reduced the value of non-prime loans,” it said. “This was a really rough quarter for the subprime industry overall,” said Chief Executive Mark Ernst.

In June of 2007, hedge funds involving collateralized subprime mortgage loans started showing signs of distress. In June, 2007, The Bear Stearns Companies, Inc. announced that it was preparing to shut down two hedge funds, Bear’s High-Grade Structured Credit Strategies Enhanced Leverage Fund and High Grade Structured Credit Strategies Fund. This announcement led to concerns about the subprime mortgage sector and triggered worries that worse is yet to come.

“The unraveling of the Leverage Fund is at best an embarrassment for Bear Sterns, and at worst, it threatens to have a ripple effect on valuations across the subprime sector,” said Kathleen Shanley, an analyst at independent corporate bond research firm Gimme Credit. Bear’s two funds were shut down after suffering deep losses from investments backed by subprime mortgages. Creditor Merrill Lynch seized about $850 million of assets from the funds on June 20, 2007 and commenced selling some of those assets.” Some guys made bad bets so we may see some more sellers out there,” said Dan Castro, managing director at GSC Group in New York. “There isn’t going to be a flood of hedge funds liquidating, but other guys are having problems.”

The heady issuance of these risky subprime loans helped fuel the U.S. real estate boom and also provided a windfall to Wall Street firms, which have made big money packaging these loans and selling them as securities to investors like hedge funds. “These instruments are held by a very large number of accounts – not just hedge funds, but all sorts of investment vehicles – that thereby highlights the hit everyone is taking from this process,” said Charles Diebel, an analyst at Nomura International in London.

Beyond losses, there are also concerns that investors may lose their appetite for risky bonds and loans and reduce the availability of financing for leveraged buyouts. The U.S. Securities and Exchange Commission reported that it is keeping a close eye on the fate of the Bear Stearns funds amid concerns of any “potential systemic fallout.”

Similarly, on July 3, 2007, United Capital Asset Management (UCAM) announced that it has temporarily suspended payments from four of its Horizon funds following losses from its investment in subprime mortgage bonds. Reportedly, Florida-based UCAM has over $600 million of investor money invested in CMOs.

On July 10, 2007, Standard & Poor’s said it would cut credit ratings on $12 billion in bonds backed by subprime mortgages because losses will rise beyond its previous expectations. The e-mailed statement indicated that ratings of 612 classes of residential mortgage-backed securities were placed on CreditWatch with negative implications. The bonds represent 2.1 percent of the $565.3 billion of similar bonds rated by Standard & Poor’s during 2006.

“We expect that the U.S. housing market, especially the subprime sector, will continue to decline before it improves, and home prices will continue to come under stress,” Standard & Poor’s said.”

Investors have criticized Standard & Poor’s, Moody’s Investors Service and Fitch Ratings because their ratings on bonds backed by mortgages to people with poor or limited credit don’t reflect the fastest default rate in a decade. Prices of some bonds backed by subprime mortgages have declined by more than 50 cents on the dollar in 2007 while their credit ratings didn’t changed.

Standard & Poor’s announced on July 12, 2007 that it downgraded $6.39 billion of subprime residential mortgage-backed securities.

Hours after Standard & Poor’s announcement on July 10, 2007, Moody’s Investors Service announced that it cut its ratings for 399 residential mortgage-backed securities, citing higher-than-expected delinquencies in the underlying loans. Moody’s Investors Service has an additional 32 securities under review for possible downgrade. The securities were originated in 2006, are backed mostly by first lien adjustable and fixed rate subprime loans, and their downgrades would affect a total of $5.2 billion in debt.

The announcements by Standard & Poor’s and Moody’s Investors Service on July 10, 2007 led to the dollar’s sell-off. The dollar weakened broadly on July 11, 2007, striking a record low versus the euro and a 26-year trough against sterling as growing fears surrounding the U.S. subprime mortgage and credit sectors gripped financial markets, concerns heightened after two ratings agencies issued warnings on more than $17 billion of debt linked to risky mortgages, made investors less willing to take on risk.35

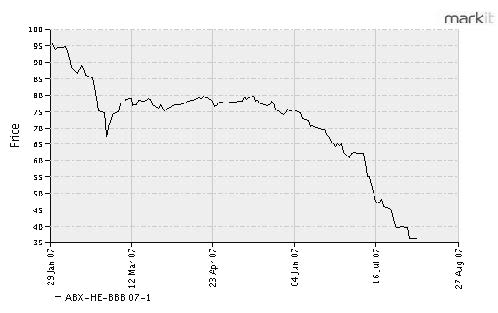

On July 11, 2007, benchmark ABX indexes opened lower following the prior day’s sharp selloff and record low close, after major credit rating agencies started to cut ratings on $17.3 billion of subprime mortgage securities. The ABX Index is a series of credit-default swaps based on 20 bonds that consist of subprime mortgages.

A decline in the ABX Index signifies investors sentiment that subprime mortgage holders will suffer increased financial losses from those investments. There are four ABX series available 06-1, 06-2, 07-1 and 07-2 – which correspond to when subprime mortgages were issued and securitized.

The 06-1 corresponds an ABX index launched in the first half of 2006. Each series is cut into tradable tranches that are valued by their order in the financial recovery from a subprime mortgage investment. The tranches are AAA, AA, A BBB and BBB-. The ABX 07-1 “BBB-” index is tied to loans made to risky borrowers in the first half of 2006. This index suffered steep declines during 2007 due to the subprime meltdown36 as shown in the following chart:

On July 12, 2007, the top Republican on the U.S. House Financial Services Committee introduced legislation that would create a national registry and set new standards for mortgage originators in response to the subprime mortgage crisis. Spencer Bachus, of Alabama, said in a statement that his bill, called the Fair Mortgage Practices Act, would curb unscrupulous lending and increase consumer protections. The bill would set licensing standards for mortgage loan originators and log those lenders in a national registry.

Loan originators would have to submit to a criminal background check and FBI fingerprinting, and loan originators convicted of fraud would not qualify under the new licensing standards, according to the legislation. The bill also would require mortgage lenders to weigh a borrower’s ability to repay the loan and would restrict penalties against homeowners who refinance out of a high-cost loan.

On July 20, 2007, Federal Reserve Bank of St. Louis President William Poole said “investors who lost money buying subprime mortgage-linked securities got what they deserved.” “The punishment has been meted out to those who have done misdeeds and made bad judgments,” Poole told reporters in St.

Louis after a speech on the market for mortgages to borrowers with sketchy or weak credit histories. “We are getting good evidence that the companies and hedge funds that are being hit are the ones who deserve it.” Obviously, Mr. Poole forgot to mention that there are many individual American investors who invested in CMOs, some tied to subprime mortgages, that were fraudulently induced into buying these investments from the very same companies that Mr. Poole was criticizing.

It is this author’s opinion that the Federal Reserve, who could have influenced the creation of regulations on subprime lending, was critical of a banking industry that federal regulators, including the Federal Reserve, should have policed long before the subprime meltdown.

On August 3, 2007, American Home Mortgage Investment Corporation announced it will close most operations and nearly 7,000 employees will lose their jobs as the lender becomes one of the biggest casualties of the U.S. housing downturn. On August 8, 2007, AHMIC filed for bankruptcy protection.

American Home Mortgage Investment Corporation originated $59 billion in loans in 2006. Founded in 1987, the company said it had by 2006 become the 10th largest U.S. retail mortgage lender. The company offered many “Alt-A” mortgages, which fall between prime and subprime in quality; however, about half of those mortgages were adjustable-rate loans and it has made many loans that allow borrowers to produce little documentation of income or assets. It recently commanded about 2.5 percent of the U.S. mortgage market.

Next: The Secondary Market and Government Sponsored Entities (GSEs)

CONTACT US FOR A FREE CONSULTATION

Se Habla Español

Contact our office today to discuss your case. You can reach us by phone at 844-689-5754 or via e-mail. To send us an e-mail, simply complete and submit the online form below.